Blogs, Articles & News

Nordic Calm: A January Reflection on Work, Wellbeing and Balance

This January I had a lovely start to the year attending a wedding in Liverpool. I met lots of lovely people, one of whom was Finnish. As we spoke what struck me was how calmly he spoke about life. It reminded me of my conversations with an old university friend who...

Understanding the New Property Wealth Tax: Insights From the Specialist Property Accountants

The High Value Council Tax Surcharge (HVCTS) or mansion tax was one of many measures introduced during the Autumn Budget at the end of November. It has caused concern for property owners in regions with high average property prices, as well as for landlords, investors...

Advice on Managing UK Inheritance Tax Reforms From the Accountants for Landlords

The numerous reforms and announcements made at the Spring Statement and the Autumn Budget in 2025 have affected landlords and other property professionals in various ways. This includes the changes to Inheritance Tax (IHT) rules, which are of particular concern to...

Advice on Preparing for Making Tax Digital From Our Team of Accountants for Contractors

As most contractors will be aware, Making Tax Digital (MTD) has been a phased introduction of mandatory changes to the way businesses and self-employed professionals submit reports to HMRC. This started with declarations for VAT-registered companies and will become...

Key Advice From the Accountants for Hospitality Businesses: How to Avoid Tax Traps

Reports earlier this year found that as many as a third of businesses in the hospitality sector were trading at a loss, as companies struggled with the increases in NICs, business rates, minimum wage reforms, and NIC thresholds. Separate articles have also reported...

The Value of Advisory Services and Financial Planning Support From Contractor Accountants

Contractor's accountancy requirements vary considerably from those of professionals and companies working in other sectors. This is down to several aspects, including the nature of project-based working and financing, complex payment systems between contractors,...

Lessons from Croatia

A Week That Felt Like a Month I recently returned from a family holiday in Dubrovnik – a beautiful, historic town I’d highly recommend. Nestled along the Adriatic coast, Dubrovnik is a tapestry of terracotta rooftops, ancient stone walls, and shimmering blue waters....

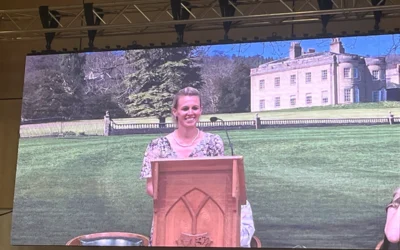

Continued Growth for James Todd & Co in Fareham

We are pleased to share an exciting update in the growth of James Todd & Co. Our Fareham office has taken another step forward with the acquisition of JM Solutions, a respected accountancy practice based in Southampton. Over the past few years, our Fareham office...

Tips From a Construction Accountant on Job Costing, Project Tracking and Financial Controls

The construction sector has been bucking national trends, outperforming other industries, contributing significantly to GDP and combating rising unemployment levels elsewhere. Still, it's also a segment that requires diligent and specific cost management, something...

Lessons from Newquay: Why Taking a Break Makes You a Better Leader

A Trip with a Twist My husband and I have just returned from a five-day break in Newquay. The main reason? To take our daughter to the Boardmasters festival and stay nearby - just in case! If you’re a parent, you’ll know the mix of pride and anxiety that comes when...

Balancing Act: Finding Fulfilment This Summer

Summer is in full swing, and the change in mood is palpable. The days are longer, the weather’s warmer, and many of us are leaning into the lighter, more relaxed pace that comes with BBQs, seaside trips, and time away from work. It’s a time to unwind and reconnect...

Why Every Developer Should Work With a Specialist Property Accountant

Property developers work in a sector that commands considerable financial management. Developers benefit from expert advice when making decisions around property or land acquisitions, marketing completed developments, and securing opportunities to build affordable...

End of Term, Olympic Gold and the Power of Team

The End-of-Year Rush It’s the end of the school year, and with it comes the familiar frenzy of activity: school trips, sports days, discos, and BBQs. Add to that the challenge of arranging childcare and managing the daily juggle, and it’s little wonder that parents...

Lessons From The Water

Two weeks ago, James Todd & Co took to the water for the very first time, entering the annual Dragon Boat Race on Chichester Canal. The event, held in support of CancerWise and The Chichester Rotary Club, brought together a range of local teams for a fun,...

The Power of Consistency – What Tennis Teaches us About Business Success

Our family loves tennis. My husband David was a coach for over 30 years, so the sport has always been a big part of our lives. Last week, we enjoyed a brilliant day at the Eastbourne Open, soaking up the atmosphere and watching some top players showcase their skills...